credit_score

You Can Save Thousands of Dollars if you have a good Credit Score: Here You Can Understand how to check your credit score for free.

Of course, checking your credit score is an important way to know about your financial health, what’s more, it can give a supportive understanding of whether you’re probably going to meet all requirements for a loan or credit card. The absolute most straightforward ways of checking your credit score, as well as the top reasons to consistently monitor your credit score.

Your credit score is probably the most important thing to know about your financial health, nowadays it’s simpler to check than at any other time,

Before you apply for a personal loan or mortgage Loan or credit card, it’s significant to know your credit score, since it will give you an understanding of what offers you might be eligible for and what interest rates you are hoping for.

it doesn’t hurt your credit health if you are Checking your credit score And even if you’re not applying for a Loan.

It’s the smart thing to check your credit score regularly.

As a matter of fact, the basic way of checking your credit score is one way you can increase your credit score.

If you take a look at your score, it can expose you to potential fraud or mistakes in your reports.

Checking your score month to month might assist you with getting issues early and getting an early advantage on

settling them.

Before checking your credit score you should know about credit score

A credit score is usually between 300 and 850, it’s a three-digit number, that results from an analysis of your credit data. That significant number tells lenders your potential credit risk and ability to repay the loan. The credit score considers a variety of factors such as payment history and length of credit history from your current and past credit accounts.

The credit score range varies depending on the model use (FICO vs VantageScore) and the credit bureaus

(Experian, Equifax, and TransUnion) that pull the scores. Ratings usually include poor/poor, fair/average,

good, and excellent/extraordinary. The rating you get depends on your credit score. Below, You can use Experian’s estimates to check which rating you fall into.

Credit Score Types: FICO vs VantageScore

mainly there are two credit scoring Models: FICO and VantageScore.

However, most lenders prefer to FICO scoring Model because Its model is used in over 90% of loan decisions.

FICO and VantageScore credit scores have a few similarities: In both, scores range from 300 to 850, and payment history is the most powerful factor in deciding your score. Yet, they contrast in precisely the way that they weigh and rank a few different cases.

What is the process to calculate a credit score?

The credit score is calculated differently based on the credit scoring model.

Here are the key factors to consider when considering FICO and VantageScore scoring patterns.

FICO Score

Payment history (35%): Whether you paid past credit accounts on time?

Amount outstanding (30%): The total loan amount and loans that you are using as compared to your

total credit limit, Also known as your utilization rate

Length of credit history (15%): The length of your credit.

New Credit (10%): How often do you apply and open new accounts?

Credit Mix (10%): You have access to a variety of credit products including credit cards, installment loans,

Finance company accounts, mortgage loans, etc.

VantageScore

Enormously important: Payment history.

Highly important: Type and duration of credit and percentage of credit limit utilized.

Moderately important: Total debt and balance.

Less Important: Available credits and recent credit transactions and inquiries.

How To Define Your Credit Score

Easy to Check your credit score, yet just realize the number isn’t sufficient. To capitalize on your score — and further develop it — it’s important to decipher your score and acknowledge the report all in all. This includes understanding the five credit score reaches and how each affects lenders.

Poor (300 to 579). A score somewhere in the range of 300 and 579 is well beneath the public normal FICO Score of 711.

Along these lines, banks consider borrowers with an unfortunate FICO rating to be dangerous and are less willing

to stretch out credit to them. All things considered, a few moneylenders offer bad credit personal loans

customized explicitly to low-credit borrowers.

Fair (580 to 669). In any case, underneath the public normal, a fair FICO rating somewhere in the range of 580 and 669 for the most part

qualifies borrowers for the credit. In any case, these advances or credit extensions are bound to accompany higher

interest rates, lower limits, and shorter terms. Borrowers with appropriate credit can get to better terms by picking

a secured loan which gives low risk to lenders.

• Good (670 to 739). If a borrower’s score is close to or above the national average, banks consider it in

great reach. This implies you are less inclined to loan and are bound to meet all requirements for great terms.

• Very good (740 to 799). If a borrower’s credit score is above average that indicates to lenders that a borrower is credible and likely to make payments on time. For this reason, borrowers with very good credit scores generally have access to more competitive credit cards and better loan terms.

• Extraordinary (800 to 850). If the credit score of any Borrowers with exceptional credit is more likely to be approved for larger loans, and lines of credit generally get low-interest rates.

The Importance of Checking Your Credit Score:

• It helps you understand your financial situation in a better way. Without knowing your credit score,

Being elaborate, it is impossible to fully understand your financial situation. Understanding your score can help you decide if it is a great time to buy a home, apply for an auto loan, or make other big purchases.

• Makes it easy to improve your score and qualify for better rates. By understanding your

score and how it’s calculated, you can take strategic steps to improve your credit score over time or build it up for the first time. In fact, many scoring websites let users simulate changes in their scores based on various factors such as timely payments, additional payments, and new credit applications.

• If you compare based on the eligibility requirements of your financial products.

if you know your credit score which can give you an idea of whether you’re likely to be eligible or not and whether it’s the right time for applying. In addition, lenders offer a personal loan pre-qualification process that lets potential borrowers see what type of interest rate they may get on based on income and credit score.

• Regularly Checking your credit score makes it more straightforward to recognize unusual activity that could indicate fraud. With a tremendous and unforeseen expansion in your credit usage before long

In the event that this occurs, you can record a question and get your credit in the groove again more rapidly.

Does Checking Your Credit Score Lower It?

If you check your credit score through a free credit score provider, it is treated as a soft credit inquiry which is not shown in your credit report. For this reason, checking your credit score doesn’t affect it. Instead, the credit score is calculated based on five key factors: payment history (35%), amount of loan (30%), length of credit history (15%), amount of new credit (10%), and credit mix. (10%) We recommend that you check your credit score at least once a month.

Which credit score do you need to check?

John Ulzheimer, formerly FICO and Equifax’s credit expert, suggest checking both your FICO and VantageScore credit score to get an exact image of what your money lender will see. All things considered, no one can tell what credit score your potential loan specialist will pull. Additionally, checking your credit score is free, so you can get benefits from checking it.

What doesn’t affect your credit score?

There are numerous normal misinterpretations about what impact your credit score.

“Consumers sometimes focus on the things that don’t matter to their credit score. The most common information is

about wealth,” Ulzheimer says.

“Salaries, retirement account balances, the value in your home, net worth… whatever features

The amount of cash you have or are worth is not measured by your credit score.”

Other factors that do not affect your credit score include race, religion, nationality, gender, marital status,

age, political affiliation, education, occupation, job title, employer, employment history, where you live, or

your net worth.

How does your credit score affect the credit cards you qualify for?

Your credit score is not the same as your credit report. A credit report that has a more comprehensive view of your credit Shows definitive data about your credit history and current credit status. Personal data such as credit report details (name, address, social security number), Credit accounts (payment history, credit limit, account balance), independently available reports (lien, liquidation, abandonment), and check your credit. three fundamental

The credit divisions that issue the report are Experian, Equifax, and TransUnion.

“Your credit scores are an intermediary for the strength of your credit report,” Ulzheimer says.

“So in the event that you won’t need some investment to pull and audit each of your three credit reports,

Then, at that point, at any rate, you should check your credit score.”

Three ways to check your credit score

Consumers have a number of options for accessing their credit scores, Beyond Visiting the Three Major Credit Agencies.

1. Free Credit Scoring Website

The best way to check your credit score for free is by visiting a free credit scoring website. These websites generally provide access to your credit report, score, and/or credit monitoring and are updated anywhere from weekly to monthly. There is no fee to sign up for basic credit score updates. Although, Some websites offer more advanced services for a monthly fee.

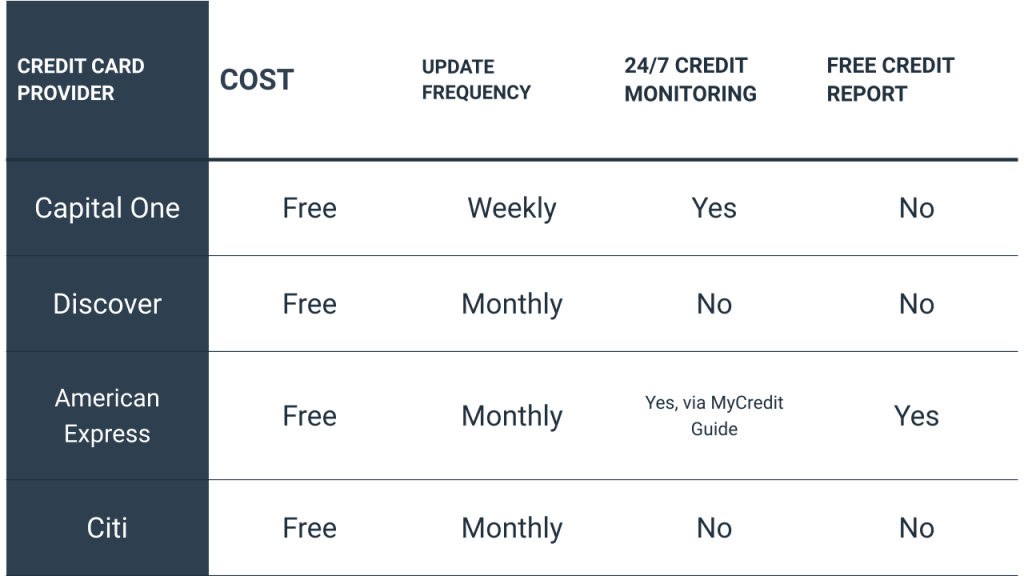

2. Your Credit Card issuer’s

Many credit card issuers also offer cardholders the facility to check their credit scores for free.

Often, these tools include access to view your score history and see what caused recent changes.

Some providers let customers predict how their scores will react to variables such as timely payments,

The credit limit increases and takes out a mortgage.

However, keep in mind that most providers require cardholders to opt into the service, so make sure you

Sign up if you want to access your score.

Here’s a look at popular credit card providers with credit score tools.

Free credit score providers

Most credit card issuers provide access to their cardholders making it simpler than ever to check and get your score.

A few lenders, like Citi and Discover, give free FICO Scores, while others, like Chase Capital One, give free VantageScores.

You can check your credit score within five minutes by signing into your credit card issuer’s site or a free credit score service provider and exploring the credit score segment. There will regularly be a dashboard posting your score and the factor that impact it.

FICO and VantageScore will pull your credit report from one of the three significant credit agencies, Experian,

Equifax or TransUnion.

Here are some free credit score providers that you can get to, regardless of whether you’re a cardholder:

CreditWise from Capital One: Free VantageScore from TransUnion

Pursue Credit Journey: Free VantageScore from TransUnion

Find Credit Scorecard: Free FICO Score from Experian

These providers additionally give knowledge into the key variables influencing your credit score, test systems on how

certain activities might influence your credit and accommodate ways to further develop your credit score.

How does your credit score affect the credit cards you qualify for?

You can qualify for more cards even with better interest rates if your credit score is high.

If you have an excellent credit score, you will have a better eligibility gap for a premium credit card, Compared to the Chase Sapphire Reserve®.

In the meantime, if you are new to credit or want to improve your bad credit score, you should look into it. Secured cards, such as the Discover It® Secured Credit Card. This card gives you access to a credit card after you have entered the refundable security deposit.

Non-profit credit counselor

Credit counseling is a service that aims to help consumers get out of debt. This can include providing money management advice, creating a budget, working with creditors, building healthy financial habits, and helping borrowers plan their loan repayments.

Debt settlement and Paid credit repair services can negatively affect your credit score in the long run,

but nonprofit credit counselors are a safe and reliable way to understand your credit score and improve

your finances. If you are interested in working with a credit counselor, visit the National Foundation for

Credit Counseling to be connected to a reputable service provider.

This post is only for information purposes only

Thanks anew for the blog article.Thanks Again. Will right of entry on

смотреть порно видео онлайн 2020 https://ebucca.com/ порно видео онлайн на кухне

порно красивые стоны

русское домашнее групповое порно видео

порно губы девушки

русская жена снимает домашнее порно

порно молодой семейной пары

зрелые волосатые порно hd

русское голых зрелых порно

русское порно ебут зрелых

скачать порно сосущие

порно с красивыми кореянками

5ccfe8e

С помощью нашего оборудования Вы имеете возможность качественно и с максимальной производительностью дозировать и упаковывать практически в любом весовом диапазоне: сыпучие продукты, пылящие, штучные, замороженные, жидкие, пастообразные, непищевые продукты, транспортная упаковка, крупногабаритные, длинномерные и объемные изделия https://www.kondhp.ru/products/kotly-parovye-nizkogo-davleniya-kp-nd

Использование новейшей технологии и систем автоматизированного управления процессами взвешивания и дозирования гарантируют одновременно максимальное быстродействие и точность https://www.kondhp.ru/products/testootsadochnaya-trekhbunkernaya-mashina-triomax

Наличие на складе запасных частей к оборудованию позволяет в короткие сроки решать вопросы с ремонтом и гарантийным обслуживанием https://www.kondhp.ru/products/testootsadochnaya-mashina-mtk-50

Обновлено 14 июля 2017Модель ХПЭ-500 предназначена для выпечки широкого ассортимента: хлеба пшеничного, ржано-пшеничного формового и подового хлебобулочной продукции мучных https://www.kondhp.ru/products/dozator-shokolada-s-ruchnym-ili-poluavtomaticheskim-upravleniem

https://www.kondhp.ru/products/testodelitel-ruchnoi-l4-shpm-1

https://www.kondhp.ru/products/farshemeshalka-lopastnaya-vakuumnaya-na-150-litrov-fm-150v

Предлагаем противни хлебопекарные алюминиевые, штампованные с закругленными углами, перфорированные и без https://www.kondhp.ru/products/khomuty-dlya-krepleniya-i-germetizatsii-soedineniya-shlangov-i-gibkikh-truboprovodov

Размер противней (495 х 750)- подходят для ротационных печей ПР -150 (Белогорье) и Ревент https://www.kondhp.ru/products/mashina-testomesilnaya-a2-khtiu

https://www.kondhp.ru/products/okhlazhdaiuschii-stol-universalnyi-dlya-razlichnykh-konditerskikh-mass-marmelada-sufle-grilyazha

https://www.kondhp.ru/products/mashina-pomad-shae-1000-ispravl

работает по принципу раскручивания специальной тележки внутри камеры https://www.kondhp.ru/products/mashiny-temperiruiuschie-tmp-i-tme-parovye-i-elektricheskie

Нагрев происходит за счет ТЭНов, а распределение воздуха – при помощи вентиляторов https://www.kondhp.ru/products/vakuum-apparat-nachinochnyi-s-meshalkoi

Все вышеперечисленные параметры регулируются, так как для разного вида хлебобулочных изделий требуются разные режимы https://www.kondhp.ru/products/testomesilnaya-mashina-sh2-kht2-i

Такая печь значительно увеличит производительность

Лучше всего выбрать вакуумно-поршневую модель (комбинированный тип устройства) https://www.kondhp.ru/products/universalnaya-delitelno-zakatochnaya-mashina-dzm-pnevmoprivod

Такое устройство способно делить тесто, как по объему, так и по весу https://www.kondhp.ru/products/avtomaticheskaya-elektricheskaya-pech-dlya-vypechki-polovinok-pesochnogo-pechenya-s-nachinkoi-tipa-oreshki

Однако оно имеет максимальную точность и при этом не сжимает и не разрывает тесто https://www.kondhp.ru/products/mukoproseivatel-mpm-800

Важно понимать, что в статье представлены усредненная стоимость хлебопекарного оборудования для открытия мини-пекарни https://www.kondhp.ru/categories/nasosnoe-oborudovanie

В целом, можно приобрести как более дорогие, так и более дешевые агрегаты https://www.kondhp.ru/categories/turetskoe-oborudovanie-khlebopekarnoe-i-konditerskoe

От некоторых устройств можно отказаться и заменить их ручным трудом https://www.kondhp.ru/products/upakovochnaya-mashina-poluavtomaticheskaya-vertikalnaya-upm-p-i

Всё зависит от целей и направленности мини-пекарни https://www.kondhp.ru/products/ekstruder-odnoshnekovyi-dlya-proizvodstva-vozdushnykh-kukuruznykh-palochek-i-kormov

My coder is trying to convince me to move to .net from PHP. I have always disliked the idea because of the expenses. But he’s tryiong none the less. I’ve been using WordPress on numerous websites for about a year and am nervous about switching to another platform. I have heard great things about blogengine.net. Is there a way I can transfer all my wordpress posts into it? Any help would be greatly appreciated!

Greetings from Florida! I’m bored to death at work so I decided

to browse your blog on my iphone during lunch break.

I really like the knowledge you present here and can’t wait to take a look when I get home.

I’m shocked at how quick your blog loaded on my cell phone ..

I’m not even using WIFI, just 3G .. Anyhow, awesome site!

That means you’ll get the idea some new features and from access to additional channels where you can win visibility, without having to modify import of some complicated, handbook migration process. https://googlec5.com