ITR 2022

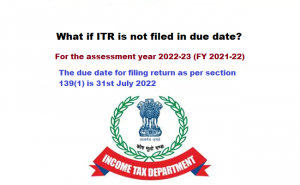

It is fine if you have already filed your return before the deadline. But what if you do not file ITR by July 31?

There is no expansion to documenting the personal assessment form (ITR), yesterday, July 31, was the last day for recording the expense form for the monetary year 2021-22 or evaluation year 2022-23.

The Indian government didn’t expand the ITR cutoff time, in spite of the fact that residents guaranteed that they couldn’t document ITR because of specialized reasons and Errors. Numerous clients have grumbled about specialized misfires on the e-documenting site. In any case, the middle has clarified that there is no arrangement to expand the ITR recording due dates this year. While citizens have mentioned the public authority to broaden the due date for recording ITR, the public authority has would not do as such.

In FY22, more than 50 million ITRs are supposed to be recorded. Nonetheless, authoritatively the specific number has not been uncovered at this point. More than 6.5 million had been recorded starting around 11 pm on the last day, July 31.

In any case, consider the possibility that you can’t record ITR 2021-22 preceding the due date. What could you at any point do now to stay away from any legitimate activity from the Central Board of Direct Taxes (CBDT)?

The hashtag “#Extend_Due_Date_Immediately” was trending on Twitter, with inescapable solicitations for a quick expansion.

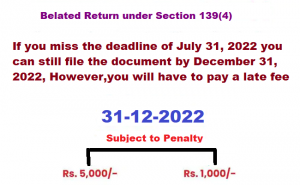

Assuming you missed the July 31 cutoff time, you still have time till December 31, 2022 to record your return. Nonetheless, there will be a late charge. There will be further monetary misfortune.

Belate ITR

A belate ITR can be documented by the citizens who have missed their unique cutoff time. It very well may be documented before December 31 of that very year. Thus, this year the last date for recording the late ITR is December 31, 2022. Be that as it may, the public authority could later report an augmentation as well.

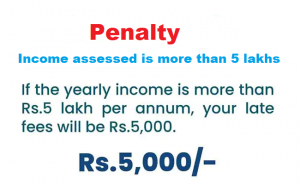

Be that as it may, a late ITR likewise draws in a punishment. Under segment 243(F) of the Income Tax Act, 1961, the individual should pay a late charge of Rs 10,000 in the event that they miss the ITR cutoff time. In her Budget 2021 discourse, finance minister Nirmala Sitharaman diminished this add up to Rs 5,000.

This fine is just appropriate on the off chance that the available pay is more than Rs 5 lakh for each annum. For citizens with a yearly pay of not as much as Rs 5 lakh for every annum, the late expense remains at Rs 1,000.

Likewise, as far as possible under the new expense system is Rs 2.5 lakh per annum, an individual with pay, not exactly that isn’t responsible to pay any late charge.

For citizens with a yearly pay up to ₹ 5 lakh, there is a ₹ 1,000 late fine. The late charge is ₹ 5,000 assuming that your yearly pay surpasses ₹ 5 lakh.

Be that as it may, you will not be expected to suffer a late documenting consequence assuming your complete gross pay is not exactly the essential exclusion sum.

The annual assessment system sets the essential exclusion limit that you pick. For citizens under 60 years old, the essential expense exclusion limit under the old system is ₹ 2.5 lakh.

The essential exception limit for those in the age gathering of 60 to 80 years is ₹3 lakh. For those over 80 years old, as far as possible has been fixed at ₹5 lakh.

Under the new concessional personal expense system, the essential duty exception limit is ₹ 2.5 lakh, regardless of the age of the citizens.

Gross absolute pay is the sum before any derivation permitted by area 80C to 80U of the Income Tax Act.

Aside from late expenses, there are numerous results of missing cutoff times. On the off chance that you miss the cutoff time, you should pay interest on the late duty installment.

“Some assessment might be payable while documenting ITR, for instance, interest and profit. TDS is deducted at 10%, yet you are in 20% or 30% duty chunk, so the distinction measure of expense is TaxSpanner’s prime supporter and CEO Sudhir Kaushik told ANI, “To be paid alongside revenue according to segment 234A at the pace of 1% each month.”

Assuming that you record the return with time to spare, you might wind up gathering neglected charges. Notwithstanding, assuming that you miss the cutoff time, you will be compelled to retroactively build neglected expenses and interest by July 31.

In the event that the remarkable sum is paid after the fifth day of a month, premium ought to be paid at the pace of 1% each month all month long.

A citizen can diminish his risk by changing misfortunes from business exercises or by selling resources against other pay. ITR should be submitted according to schedule to convey forward the misfortune.

“Misfortune (other than misfortune from house property) isn’t permitted to be conveyed forward, assuming you miss the due date. Misfortune should be pronounced discounted of property/shares/capital resources constrained to sell during Corona and ought to be recorded before the due date,” Taxspanner prime supporter and CEO Sudhir Kaushik told ANI.

According to the Income Tax Act, organization misfortunes (other than speculative misfortunes) can be balanced against any head of pay, with the exception of compensation pay.

Any unnecessary misfortune can be conveyed forward for eight monetary years following the ongoing monetary year and can be counterbalanced against any allowed business income. For instance, business misfortune in monetary year 2020-21 can be balanced by business pay in monetary year 2021-22 and onwards.

The Income Tax Department can give you a notification on the off chance that you don’t record by the cutoff time or on the other hand in the event that there is a befuddle.

On the chance of notification from the Income Tax Department, Mr. Kaushik said, “During the COVID pandemic, numerous people have put resources into values as we are seeing while at the same time documenting ITR and AIS (Annual Information Statement). Consequently because of a jumble of pay. Charge notice/pronounced misfortune can likewise be anticipated for something similar.”

Assuming that you miss the July 31 cutoff time, the postponed personal expense form accommodation for the monetary year 2021-2022 is December 31, 2022.

Assuming you miss the cutoff time of December 31, 2022, discount and misfortune, you should record an interest for approbation with the Commissioner of Income Tax of your ward to convey forward the discount and misfortune. “In the event that the explanation is real, you can get authorization,” said Mr. Kaushik.

On the off chance that you owe charge, there is an immense punishment. “Assuming you find extra pay in AIS or different archives that were not pronounced in the first return or were not documented by any means, you will be at risk to pay an extra assessment of 50% of this forthcoming expense sum on recording the refreshed return in one year or less. What’s more, 100% should be paid. Extra whenever recorded following one however before two years,” he said.

What are the burdens of missing the ITR cutoff time?

There are a few different disservices of documenting the ITR after the last date.

Interest on duty: The citizen is at risk to pay interest on the due charge. It is determined from the last date of documenting the ITR. The loan cost remains at 1%.

Nice post. I was checking continuously this blog and I am impressed! Very helpful information particularly the last part 🙂 I care for such info much. I was seeking this certain information for a long time. Thank you and good luck.

Have you ever considered about adding a little bit more than just your articles? I mean, what you say is fundamental and all. Nevertheless just imagine if you added some great images or video clips to give your posts more, “pop”! Your content is excellent but with pics and clips, this site could definitely be one of the greatest in its field. Very good blog!

buy online pharmacy uk